A short contract requires that the investor

A) sell securities in the future.

B) buy securities in the future.

C) hedge in the future.

D) close out his position in the future.

A

You might also like to view...

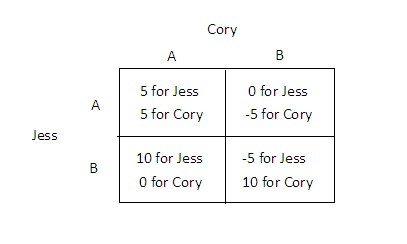

Refer to the figure below. If Cory chooses A, then Jess's best response is:

A. to choose A. B. to choose the cell in which Jess's payoff is 10. C. non-existent. D. to choose B.

Two software firms have developed an identical new software application. They are debating whether to give the new app away free and then sell add-ons or sell the application at $30 a copy

The payoff matrix is above and the payoffs are profits in millions of dollars. What is the Nash equilibrium of the game? A) Both Firm 1 and 2 will sell the software application at $30 a copy. B) Both Firm 1 and 2 will give the software application away free. C) Firm 1 will give the application away free and Firm 2 will sell it at $30. D) There is no Nash equilibrium to this game.

For each watch that Switzerland produces, it gives up the opportunity to make 50 pounds of chocolate. Germany can produce 1 watch for every 100 pounds of chocolate it produces

Which of the following is true about the comparative advantage between the two countries? A) Switzerland has the comparative advantage in chocolate. B) Germany has the comparative advantage in watches and chocolate. C) Germany has the comparative advantage in watches. D) Switzerland has the comparative advantage in watches.

What act of Congress declared restraint of trade illegal and declared any attempt at monopolizing unlawful?

a. Celler-Kefauver Act. b. Sherman Antitrust Act. c. Clayton Act. d. Robinson-Patman Act.