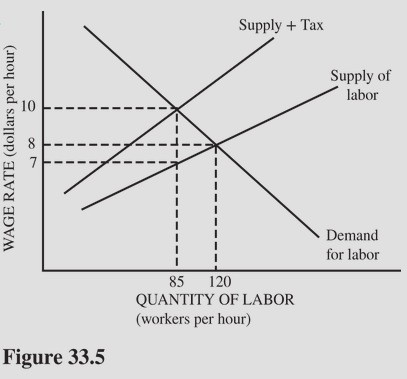

Refer to the labor market in Figure 33.5. Suppose that the government imposes a payroll tax on employers in this market. How much will the government collect in tax receipts for every worker hired?

Refer to the labor market in Figure 33.5. Suppose that the government imposes a payroll tax on employers in this market. How much will the government collect in tax receipts for every worker hired?

A. $10 - $8 = $2 per hour.

B. $10 - $7 = $3 per hour.

C. $7 per hour.

D. $8 - $7 = $1 per hour.

Answer: B

You might also like to view...

In the above figure, point B represents

A) a recessionary gap. B) a full-employment equilibrium. C) an inflationary gap. D) a decrease in aggregate demand.

A buyer's consumer surplus on a unit of a good is its value to that buyer minus what the buyer actually pays for it

a. True b. False

A tax must be progressive if an individual with a higher income pays more dollars in taxes than an individual with a lower income

a. True b. False Indicate whether the statement is true or false

The poverty rate for blacks is _____________ the poverty rate for non-Hispanic whites.

A. almost three times B. about 50% more than C. slightly higher than D. a little lower than