A retail sales tax is a proportional tax with respect to income.

Answer the following statement true (T) or false (F)

False

You might also like to view...

The market demand curve

a. is the sum of all individual demand curves. b. is the demand curve for every product in an industry. c. shows the average quantity demanded by individual demanders at each price. d. is always flatter than an individual demand curve.

Sometimes, we observe cases where the price of a product rose and the quantity bought by buyers also increased. Such cases occur due to a violation of the:

A. Law of Demand B. Law of Supply C. Allocative efficiency rule D. Ceteris paribus assumption

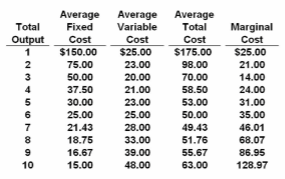

Refer to the data. If the market price for this firm's product is $87, it will produce:

A. 9 units at an economic profit of zero.

B. 6 units at a loss of $90.

C. 9 units at an economic profit of $281.97.

D. 8 units at an economic profit of $130.72.

Which of the following is the single most important source of U.S. economic growth?

A. Stability of the socio-cultural-political environment B. Improvement in the legal and human environment C. Increases in the quantity of labor D. Increases in labor productivity