The real exchange rate is defined as:

A. the nominal exchange rate plus the rate of inflation.

B. the exchange rate that would exist if nominal rates were not fixed by governments.

C. the spot exchange rate.

D. the cost of a basket of goods and services in one country compared to the cost of the same basket in another country.

Answer: D

You might also like to view...

Consider the following methods of taxing a corporation's income:

a. A flat tax, as opposed to a progressive tax, is levied on corporate profits. b. A system whereby a corporation calculates its annual profit and notifies each shareholder of her portion of the profits. The shareholder would then be required to include this amount as taxable income for her personal income tax. The corporation does not pay a tax. c. A system where the federal government continues to tax corporate income through the corporate income tax but allows individual taxpayers to receive, tax free, corporate dividends and capital gains. Which of the methods above would avoid double taxation? A) a, b, and c B) a and b only C) a and c only D) b and c only

Social Security is described as a

a. voluntary system because people freely voted for it b. age-based premium system c. employer-based premium system d. pay-as-you-go system e. system whose revenues are generated from sales tax

Changes in nominal GDP always reflect changes in real output.

Answer the following statement true (T) or false (F)

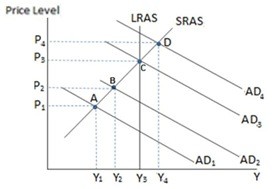

According to the graph shown, if the government decides to increase its spending, it is most likely at point:

According to the graph shown, if the government decides to increase its spending, it is most likely at point:

A. C B. D C. B D. It's impossible to tell without more information.