For this question, assume that the Fed is expected to respond to any event by keeping the interest rate constant (i.e., equal to its initial level). An unexpected tax increase will cause

A) stock prices to fall.

B) stock prices to rise.

C) no change in stock prices.

D) an ambiguous effect on stock prices.

A

You might also like to view...

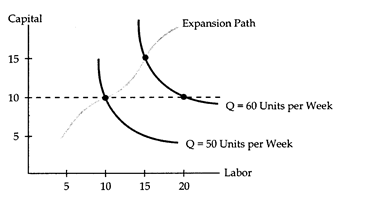

Refer to Cost of Production. In order to produce 50 units of output per week, the firm must spend at least

The following questions refer to the diagram below. The wage rate is assumed to be $12 per hour, the rental rate is assumed to be $6 per hour, and capital is assumed to be fixed in the short run at 10 hours.

a. $60.

b. $120.

c. $180

d. an amount that can not be determined given the available information.

When the Fed is ________ it is ________

A) adjusting the amount of money in circulation; issuing government bonds B) issuing government bonds; conducting monetary policy C) adjusting the amount of money in circulation; conducting monetary policy D) regulating the nation's financial institutions; conducting monetary policy

In what way, if any, does the invisible hand affect government resource allocation?

A. It enhances government efficiency by promoting competition for resources within government. B. It does not help resource allocation, as there are no competitive forces within government that automatically direct resources to their best uses. C. It rewards government bureaucrats who are most efficient at implementing public policies. D. It reduces government efficiency by sending market signals that interfere with government decision making.

Workers often have ________ contracts and so their wages are ________.

A. long-term; flexible B. long-term; sticky C. short-term; sticky D. short-term; flexible