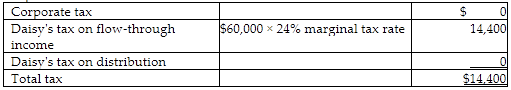

Silver Inc. is an S corporation. This year it earned $60,000 of taxable income and paid a $10,000 distribution to Daisy, its sole shareholder. Daisy has a marginal tax rate of 24%. Due to the corporation's results and the distribution paid, the IRS will receive total taxes of

A) $27,000.

B) $14,400.

C) $14,100.

D) $9,000.

B) $14,400.

You might also like to view...

During the stranger phase of leadership making, ______.

A. interests are mixed B. exchanges are high quality C. influences are one-way D. interests are group focused

In Markov analysis, we are concerned with the probability that the

a. state is part of a system. b. system is in a particular state at a given time. c. time has reached a steady state. d. transition will occur.

For a random variable X, V(X + 3) = V(X + 6), where V refers to the variance

Indicate whether the statement is true or false

Crisis response is an example of a _____ e-government application

a. government-to-citizen (G2C) c. government-to-government (G2G) b. government-to-business (G2B) d. government-to-employee (G2E)