Suppose the government of a small country has to frame a policy which would promote the level of domestic production of an import-competing industry, because domestic production is believed to create extra benefits for the country. The government believes that it has a choice of either imposing a tariff on the foreign goods or providing production subsidies to the domestic firms. Which policy should the government choose and why? Explain with a diagram. Is there a particular principle that can guide the government's decision? If so, name it and state it.

What will be an ideal response?

POSSIBLE RESPONSE: A small country cannot affect the international prices by lowering its imports, so our analysis is not complicated by any effects of the trade barrier on the country's international terms of trade. Let's consider a case where the government of the country wants to encourage domestic production of import-competing industries because it has positive extra or spillover effects elsewhere in the country. It can do that by imposing a tariff on the imports or by providing production subsidies to the import-competing industries.

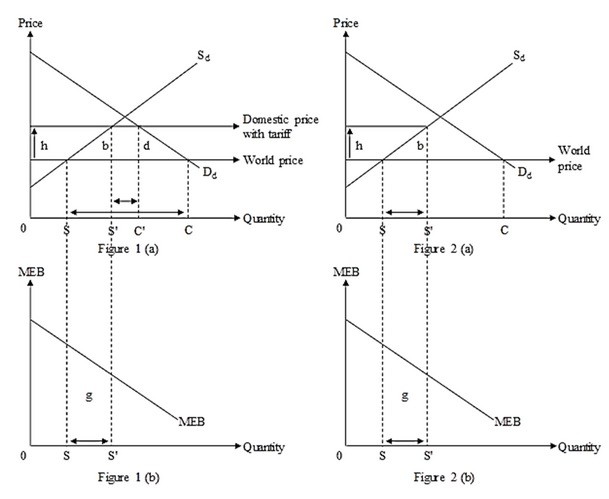

Figure 1(a) illustrates the impact of a tariff imposed by the government. Dd is the domestic demand curve. Sd is the pre-tariff domestic supply curve. The domestic price with tariff rises by the amount 'h'. Post-tariff, domestic production increases by SS' and domestic consumption declines by CC'. Therefore, the quantity imported decreases from SC units to S'C' units. The deadweight losses are given by the areas of the triangles b and d. Area b is the production effect of the tariff. It represents the loss arising from shifting from lower-cost imports to higher-cost domestic production. Area d is the consumption effect of the tariff. It is the consumer surplus loss on the reduced domestic consumption. In Figure 1(b), area g represents the gain in marginal extra or external benefits (MEB) due to the increase in domestic production from 0S to 0S'. So, the net national gain is (g - b - d).

Figure 2(a) instead depicts the effect of production subsidy. Here, the amount of subsidy provided by the government is denoted by the amount h which is equivalent to the amount of price rise in the case of the tariff. Domestic production also increases by an equivalent amount of SS'. But the domestic consumption remains unchanged. So, the deadweight loss in this case is only given by the area 'b' which is due to the production effect. MEB also increases by the area g, similar to the post-tariff case, which is shown in the Figure 2 (b). Here, the net national gain is (g - b).

Comparing the effects of tariff imposition and production subsidy on national well-being, we can see that, although domestic production increases by the same amount in both cases, the net national gain is larger if the government offers a production subsidy rather than if it imposes a tariff. We can say that providing the production subsidy is more efficient than the tariff because it addresses the objective of raising domestic production without generating the additional loss of area 'd', the consumption effect. This follows the specificity rule, which states that it is usually more efficient to use the government policy tool that acts as directly as possible on the source of the distortion separating private and social benefits or costs. Domestic production is the source of the extra benefits.

You might also like to view...

Currently, the price of consuming housing is lowered by the fact that home mortgage interest is tax deductible. Suppose the government proposed to eliminate this implicit subsidy of your housing consumption and at the same time lowers taxes on all other goods.

a. With housing consumption on the horizontal axis and all other consumption on the vertical, illustrate you current optimal consumption bundle. b. After looking over the government's proposal, you decide that you don't care one way or another whether the government implements this proposal. On your graph, indicate your new budget constraint and new optimal bundle under the proposal. c. I also look over the proposal and find that my current consumption bundle also lies on the budget constraint I would face under the proposal. Am I also indifferent between the two proposals? What will be an ideal response?

If the Friedman rule for long-term monetary policy were implemented, the result would be

A) inflation. B) neither inflation nor deflation. C) deflation. D) hyperinflation.

Which of following is not an important category of bias in human decision making?

A. Temptation. B. Limited processing power. C. Reluctance to change. D. Single-mindedness.

The United States has chosen to balance the competing claims of efficiency versus equality by emphasizing greater efficiency over greater equality

a. True b. False Indicate whether the statement is true or false