Effective price floors prevent the market price from falling to reach equilibrium.

Answer the following statement true (T) or false (F)

True

You might also like to view...

The price of reserves that are borrowed from the Federal Reserve is called the

A) discount rate. B) federal funds rate. C) LIBOR. D) prime rate.

An increase in the number of corporations in a portfolio from 1 to 10 reduces

a. market risk by more than an increase from 110 to 120. b. market risk by less than an increase from 110 to 120. c. firm-specific risk by more than an increase from 110 to 120. d. firm-specific risk by less than an increase from 110 to 120.

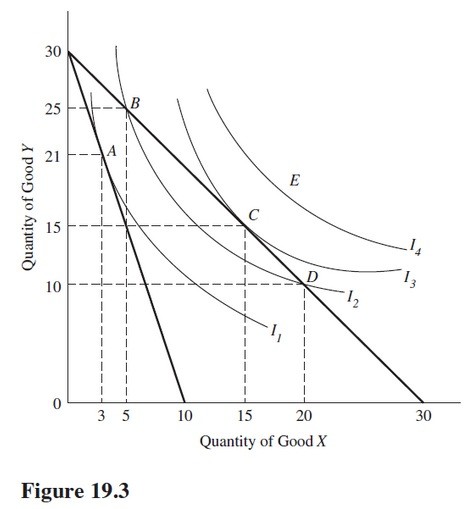

Use the indifference curves and the budget lines in Figure 19.3 to answer the indicated question. Assume the price of Y is $1 per unit. In Figure 19.3, point E

A. Is a high level of utility but not affordable. B. Is optimal and affordable. C. Gives the consumer a very high level of utility and is affordable. D. Represents a very low level of utility and is not desirable.

A market in which there are many firms each selling differentiated products is most likely a ________ market.

A. perfectly competitive B. monopoly C. monopolistically competitive D. natural monopoly