Explain the concept of notional principal used in swaps.

What will be an ideal response?

The idea of notional principal as used in swaps is a principal amount that serves as the basis for the calculations involved with swaps. The actual principal is never borrowed, lent, or exchanged.

You might also like to view...

Risk Premium refers to

A) the average difference over a long period of the interest rate on long-term bonds and the interest rate on the short-term federal funds rate. B) the average difference over a long period of the interest rate on short-term financial instruments and the interest rate on the discount rates. C) the difference between the corporate bond rate and the risk-free rate of Treasury bonds. D) the difference between prime rate and the discount rate.

Inland passage times were reduced primarily through

a. increasing the speeds of the boats themselves. b. shorter layover times. c. the government activity to clear the rivers of natural obstructions. d. learning to operate the boats at night.

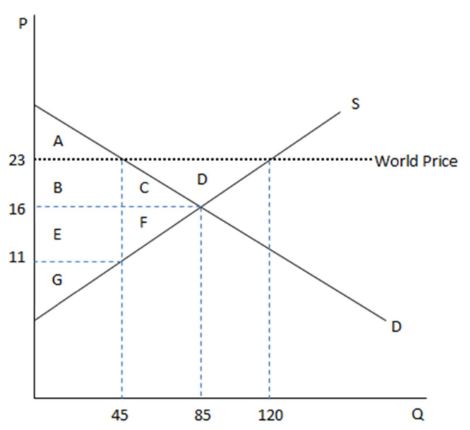

According to the graph shown, if this economy were an autarky, producers would enjoy area:

This graph demonstrates the domestic demand and supply for a good, as well as the world price for that good.

A. BCEFG

B. BCDEFG

C. G

D. EFG

The opportunity cost of holding money is

a. the dollar cost necessary to change other assets into money b. the time cost of accessing funds c. the value of the goods and services a person is able to obtain with the money d. the interest a person could have earned by holding other forms of wealth instead e. zero, because opportunity costs only apply to real assets, goods and services