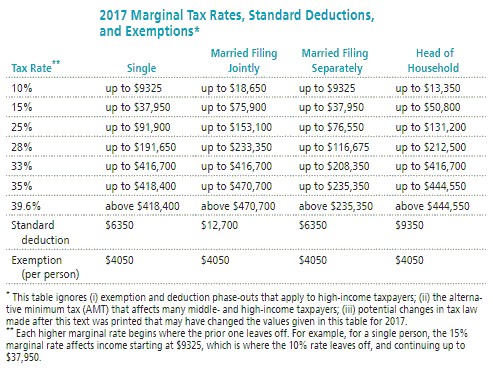

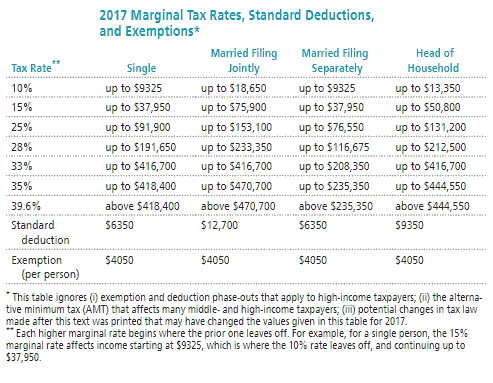

Solve the problem. Refer to the table if necessary. You are single and have a taxable income of $61,855. You make monthly contributions of $540 to a tax-deferred savings plan. Calculate the effect on annual take-home pay of the tax-deferred contribution. If necessary, round values to the nearest dollar.

You are single and have a taxable income of $61,855. You make monthly contributions of $540 to a tax-deferred savings plan. Calculate the effect on annual take-home pay of the tax-deferred contribution. If necessary, round values to the nearest dollar.

A. Take-home pay will be $2160 more per year with tax-deferred plan

B. Take-home pay will be $2160 less per year with tax-deferred plan

C. Take-home pay will be $1620 less per year with tax-deferred plan

D. Take-home pay will be $1620 more per year with tax-deferred plan

Answer: D

You might also like to view...

Solve the problem. Refer to the table if necessary. Ken is head of household with a dependent child and a taxable income of $84,493. He also is entitled to a $1000 tax credit. Calculate the amount of tax owed.

Ken is head of household with a dependent child and a taxable income of $84,493. He also is entitled to a $1000 tax credit. Calculate the amount of tax owed.

A. $20,123 B. $14,713 C. $14,376 D. $15,376

Express the sum or difference as a product of sines and/or cosines.cos (6?) + cos (4?)

A. 2 cos (5?) cos ? B. 2 cos (5?) C. 2 sin (5?) sin ? D. 2 cos (5?) sin ?

Solve the problem.If sin ? = -  , and

, and  < ? < 2?, then find tan 2?.

< ? < 2?, then find tan 2?.

A.

B. -

C. -

D.

Decide if the given number is a solution to the given equation.6x = 12; 9

A. No B. Yes