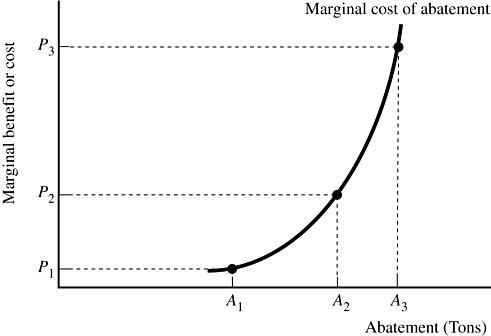

A firm that generates pollution is illustrated in Figure 9.7. Suppose the government is considering changing the pollution tax from P3 to P2. That new policy would:

A firm that generates pollution is illustrated in Figure 9.7. Suppose the government is considering changing the pollution tax from P3 to P2. That new policy would:

A. increase the marginal benefit to firms of abating, and thus encourage greater abatement.

B. increase the marginal benefit to firms of abating, causing them to generate more pollution.

C. reduce the marginal benefit to firms of abating, causing them to generate more pollution.

D. reduce the marginal benefit to firms of abating, and thus encourage greater abatement.

Answer: C

You might also like to view...

Beginning in 2008, The Federal Reserve and the U.S. Treasury Department responded to the financial crisis by intervening in financial markets in unprecedented ways. Briefly summarize the actions of the Fed and Treasury

What will be an ideal response?

In the United States, the long-run inflation rate can be expressed simply as the growth rate of money

A) plus the long-run growth rate of velocity. B) minus the long-run growth rate of velocity. C) plus the long-run growth rate of real GDP. D) minus the long-run growth rate of real GDP.

A minimum wage is an example of a

A) price floor. B) price ceiling. C) quantity quota. D) free market equilibrium.

Which of the following will cause a leftward shift of the supply curve for houses?

A.) A decrease in consumer incomes. B.) An improvement in the technology used to build houses. C.) Consumer expectations that the price of houses will increase next year. D.) An increase in the cost of construction materials.