For purposes of computing the deduction for qualified residence interest, a qualified residence includes the taxpayer's principal residence and one other residence of the taxpayer or spouse.

Answer the following statement true (T) or false (F)

True

Taxpayers can deduct qualified residence interest on their principal residence and on a second residence selected by the taxpayer. The aggregate amount treated as acquisition indebtedness for any period cannot exceed $750,000 for MFJ ($375,000 for married individuals filing separate returns). However, in the case of unmarried co-owners of a property, that limitation is extended to $750,000 per person. The $750,000 limitation refers to the amount of principal on the debt, not the interest paid.

You might also like to view...

Research has shown that auditors' qualifications of audit reports are better predictors of going-concern problems than are Z-score models

a. True b. False Indicate whether the statement is true or false

The cash basis of accounting commonly increases the comparability of financial statements from period to period.

Answer the following statement true (T) or false (F)

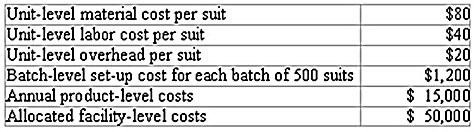

Dapper Dan produces a man's suit that sells for $200. Although the company's production capacity is 3,000 suits per year, only 2,500 suits are currently being produced and sold. At this level of production, the company incurs the following costs: Easton Clothiers has offered to purchase 500 suits as a one-time special purchase at a price of $135. Required:Prepare a quantitative analysis that indicates whether the special order should be accepted.

Easton Clothiers has offered to purchase 500 suits as a one-time special purchase at a price of $135. Required:Prepare a quantitative analysis that indicates whether the special order should be accepted.

What will be an ideal response?

How might a company try to influence its macroenvironment?

What will be an ideal response?