For a perfectly competitive firm, when MC is less than MR

A) the producer has an incentive to expand output.

B) the producer has an incentive to decrease output.

C) the producer has no incentive to change production.

D) economic profits must be positive.

A

You might also like to view...

What is the price of a unit of labor in a competitive labor market?

What will be an ideal response?

Consider the market for gasoline. Buyers

a. and sellers would lobby for a price ceiling. b. and sellers would lobby for a price floor. c. would lobby for a price ceiling, whereas sellers would lobby for a price floor. d. would lobby for a price floor, whereas sellers would lobby for a price ceiling.

Which of the following is not an automatic stabilizer?

A. Personal income tax revenue. B. Corporate income tax revenue. C. Unemployment compensation benefits. D. Property tax revenue.

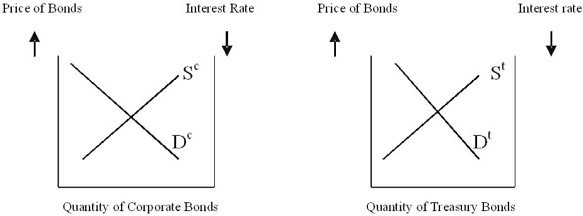

Please use the graphs to show what happens to the risk (yield) differential in each situation and why.  Assume the corporate and Treasury bonds have the same maturity;a) If the corporate bonds are default-risk free, what could you tell about the price and yields of each?b) If the corporate bonds are now viewed as having the possibility of default, what happens in each market?c) If the corporate bonds are granted tax-exempt status, what happens in each market?d) If the corporate bonds have a longer maturity than the Treasury bonds what would happen?

Assume the corporate and Treasury bonds have the same maturity;a) If the corporate bonds are default-risk free, what could you tell about the price and yields of each?b) If the corporate bonds are now viewed as having the possibility of default, what happens in each market?c) If the corporate bonds are granted tax-exempt status, what happens in each market?d) If the corporate bonds have a longer maturity than the Treasury bonds what would happen?

What will be an ideal response?