ComChip is a computer chip manufacturer. Its stock is selling at $50 per share and earnings are $2 per share. What is the stock's P/E ratio?

A) 50.00

B) 45.80

C) 25.00

D) 27.78

E) 22.50

Answer: C

You might also like to view...

Marquise Jewelers is a national chain of value jewelry stores with locations throughout North America. "Luxury service at affordable prices" is the crux of Marquise's business model, and executive management is always looking for ways to ensure that the high standards in this area are maintained. Recently, several of their stores in New England have had an uptick in customer service complaints, and they received an average Yelp rating of three stars, down from four stars during the last financial year. Marlee, the regional manager for New England, meets with Deray and Kiki, local store managers, and Tarquin, the top salesperson in their area, to discuss strategies for improving their customer service rating. Each employee writes down several goals. Given what you know about management by

objectives, which one of these goals do you consider the best option? A) within the next six months, reduce the rate of customer service complaints by half B) make sure sales staff provide customer service that goes above and beyond C) by month's end, implement a checklist of ten goals for each customer interaction D) implement a mystery shopper program, which will file periodic reports with management E) have sales staff follow up with every customer personally by phone or email

The indirect strategy of organization is appropriate for a business report when readers A) are supportive of the topic

B) must be persuaded. C) are familiar with the topic. D) want to know the results immediately.

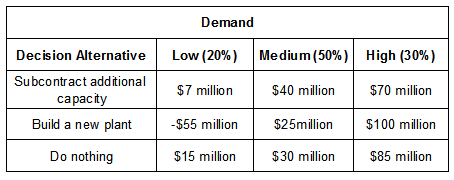

XYZ is a paint product manufacturer, and one of the plants is experiencing a substantial increase in demand. The future demand for the products could be low, medium, or high, with probabilities estimated to be 25%, 50%, and 30%, respectively. The company wants to determine the financial impact associated with the three decision alternatives under the varying levels of demand. Given the following payoff matrix, determine which option has the lowest expected regret. The company should ______.

a. subcontract additional facility.

b. build a new plant.

c. do nothing.

d. choose a new alternative

Dartis Tools Co is considering investing in specialized equipment costing $610,000

The equipment has a useful life of five years and a residual value of $69,000. Depreciation is calculated using the straight-line method. The expected net cash inflows from the investment are given below: Year 1 $210,000 2 159,000 3 160,000 4 95,000 5 136,000 $760,000 What is the accounting rate of return on the investment? (Round your answer to two decimal places.) A) 14.36% B) 16.19% C) 12.90% D) 6.45%