Often single-owner proprietorships seem more profitable than they really are. The reason for this is that

A. they are not allowed to deduct depreciation expense.

B. they often fail to consider the opportunity cost of the labor provided by the owner.

C. they receive special tax benefits compared to corporations.

D. they use different accounting procedures.

Answer: B

You might also like to view...

If we were to compare the hourly earnings of union and nonunion workers in recent years, we would find that

A) unions have not succeeded in raising the hourly incomes of their members above nonunion members. B) unions have succeeded in raising the hourly incomes of their members above nonunion members. C) state government unionized employees have earned less in hourly wages than nonunion government employee. D) union members have increased their hourly incomes, but are still below the hourly incomes of nonunion members.

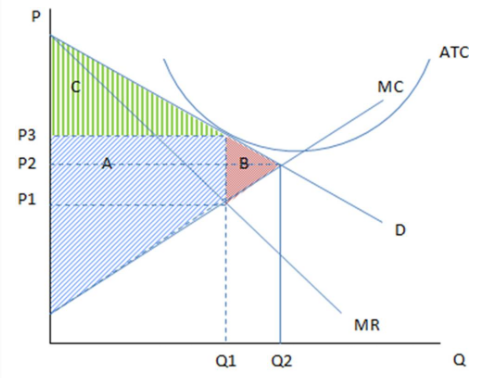

Assuming the firm in the graph is producing Q1 and charging P3, it is likely showing the cost and revenue curves of a firm in:

These are the cost and revenue curves associated with a firm.

A. the short run, and firms will enter this market.

B. the long run, and firms will enter this market.

C. the short run, and firms will leave this market.

D. the long run, and no firms will enter or exit.

The abnormal net income model defines the market value of a firm

A) is its book value minus the present value of expected economic profits. B) is its book value plus the present value of expected economic profits. C) is its book value divided by the present value of expected economic profits. D) is its book value multiplied by the present value of expected economic profits.

Roger lives in Iceland and purchases a snowmobile manufactured in the United States. This purchase is

A. both a U.S. and Icelandic export. B. both a U.S. and Icelandic import. C. a U.S. import and an Icelandic export. D. a U.S. export and an Icelandic import.