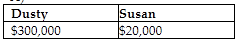

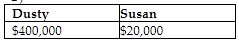

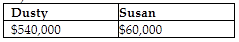

Dusty Corporation owns 90% of Palace Corporation's stock and Susan owns the remaining stock. Dusty Corporation's stock basis is $300,000 and Susan's stock basis is $20,000. Under a plan of complete liquidation, Dusty Corporation receives property with a $400,000 adjusted basis and a $540,000 FMV and Susan receives property with a $20,000 adjusted basis and a $60,000 FMV. The bases of the

properties are:

a.

b.

c.

d.

c.

You might also like to view...

Floor-ready merchandise is merchandise that is ready to be placed on the selling floor.

Answer the following statement true (T) or false (F)

Which of the following is a column in a purchases journal?

A) Cost of Goods Sold CR B) Accounts Payable CR C) Sales Revenue DR D) Other Accounts CR

Firms that need cash for long-term purposes, such as acquiring buildings and equipment or financing a business acquisition, and that wish to use debt as a means of obtaining cash, will

a. borrow from commercial banks. b. borrow from insurance companies. c. borrow from financial institutions. d. issue bonds in the capital markets. e. all of the above

Bannister invested $110,000 and Wilder invested $99,500 in a new partnership. They agreed to an annual interest allowance of 10% on the partners' beginning-year capital balance, with the balance of income or loss to be divided equally. Under this agreement, what are the income or loss shares of the partners if the annual partnership income is $202,000?

What will be an ideal response?