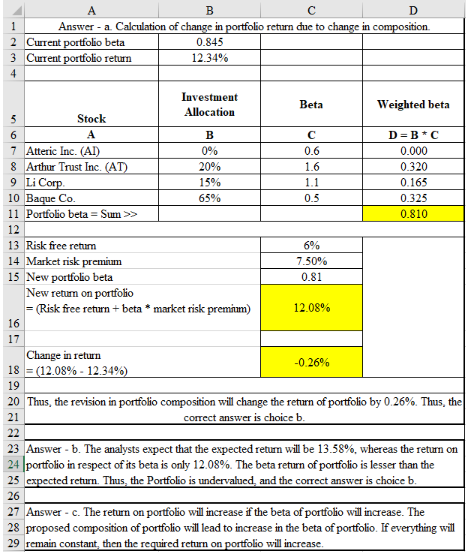

According to Lorenzo’s recommendation, assuming that the market is in equilibrium, the portfolio’s required return will change by .

Step by step solution:

You might also like to view...

Strategic alliances are

A. another name for joint ventures. B. partnerships between competitors, customers, or suppliers that may take various forms. C. arbitration. D. another name for a growth triangle.

Skipper's Souvenir Shop had comparative balance sheets and income statements that showed the following information for 2010 and 2011: Inventory - 12/31/10 $100,000 Inventory - 12/31/11 85,000 Accounts payable - 12/31/10 20,000 Accounts payable - 12/31/11 15,000 Cost of goods sold - 2011 700,000 Skipper's accounts payable balances are composed solely of amounts due to suppliers for purchases of

inventory. What is the amount of cash payments for inventory that Skipper should report on its 2011 statement of cash flows assuming that the direct method is used? A) $690,000 B) $710,000 C) $850,000 D) $550,000

Parchova is a multinational company that manufactures and sells stationery products. Customers who buy five or more products at a time from its retail outlets are given a notepad and a pen for free. In the context of customer relationship management, Parchova most likely establishes _____ with its customers.

A. limited relationships B. partial partnerships C. full partnerships D. distinct relationships

Berkshire Hathaway Inc., a large conglomerate holding company, owns a several insurance companies, a large chain of jewelry stores, and has recently purchased the BNSF Railway. Berkshire Hathaway uses a market penetration strategy.

Answer the following statement true (T) or false (F)