Which of the following was the result of the Federal Reserve’s purchase of mortgage-backed securities in 2009?

A. MBS interest rates declined, home mortgage rates declined, and the Fed turned a profit on these operations.

B. MBS interest rates declined, home mortgage rates declined, but the Fed had a loss on these operations.

C. MBS interest rates increased, home mortgage rates declined, and the Fed turned a profit on these operations.

D. MBS interest rates increased, home mortgage rates increased, but the Fed had a loss on these operations.

Answer: A

You might also like to view...

Discuss why many economists maintain that continued deficit spending by government is likely to "crowd out" (decrease) investment spending in the long run.

What will be an ideal response?

Suppose there are two countries that are identical with the following exception. The saving rate in country A is greater than the saving rate in country B. Given this information, we know that in the long run

A) the capital-labor ratio (K/N) will be greater in B than in A. B) the capital-labor ratio (K/N) will be greater in A than in B. C) the capital-labor ratio (K/N) will be the same in the two countries. D) economic growth will be higher in A than in B.

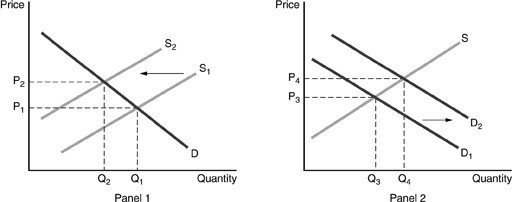

A shift from S1 to S2 reflects the change that happens when a negative externality is taken into account. A shift from D1 to D2 reflects the change that happens when a positive externality is taken into account.Refer to the above figures. A negative externality existed but has been corrected. Price and quantity will be

A shift from S1 to S2 reflects the change that happens when a negative externality is taken into account. A shift from D1 to D2 reflects the change that happens when a positive externality is taken into account.Refer to the above figures. A negative externality existed but has been corrected. Price and quantity will be

A. P1 and Q1. B. P2 and Q2. C. P3 and Q3. D. P4 and Q4.

When people decide to increase the amount of currency they are currently holding

A. the actual money multiplier will increase. B. the potential money multiplier will decrease. C. the potential money multiplier will increase. D. the actual money multiplier will decrease.