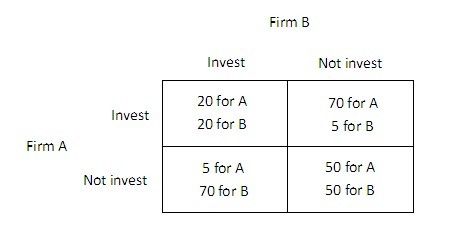

The payoff matrix below shows the payoffs (in millions of dollars) for two firms, A and B, for two different strategies, investing in new capital or not investing in new capital.  An industry spy from firm A comes to firm B and offers to pay B in exchange for B's certain and enforceable promise to not invest. What is the most that firm A will be willing to pay B to not invest?

An industry spy from firm A comes to firm B and offers to pay B in exchange for B's certain and enforceable promise to not invest. What is the most that firm A will be willing to pay B to not invest?

A. $35 million.

B. $20 million.

C. $30 million.

D. $50 million.

Answer: D

You might also like to view...

When dealing with strategic trade policy, one practical problem for government is the likelihood of retaliation by foreign governments

a. True b. False Indicate whether the statement is true or false

Normal goods always obey the law of demand because, as the price of such a good rises, the

a. fall in quantity demanded due to the substitution effect is offset by a rise in quantity demanded due to the income effect b. fall in quantity demanded due to the substitution effect is reinforced by a fall in quantity demanded due to the income effect c. substitution effect will lead to an inward shift of the demand curve d. substitution effect will lead to an increase in quantity demanded e. rise in quantity demanded due to the substitution effect is offset by a fall in quantity demanded due to the income effect

Compared to people in other nations, people in the United States pay

a. much higher taxes. b. somewhat higher taxes, on average. c. about the same amount taxes. d. lower taxes.

An oligopoly occurs when there

A. is only one seller in a market. B. are a large number of sellers in a market producing a variety of products. C. are a large number of sellers producing similar products. D. are only a few sellers in a market.