If you were the Chairman of the Fed and faced a recession, you would most likely

a. encourage commercial banks to provide loans by buying government securities

b. encourage commercial banks to provide loans by raising the discount rate

c. encourage commercial banks to provide loans by selling government securities

d. restrict commercial bank lending by selling government securities

e. restrict commercial bank lending by lowering the federal funds rate

A

You might also like to view...

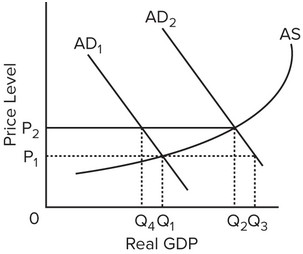

Use the following graph to answer the next question. Assume that the economy initially has a price level of P1 and output level Q1. If the government implements expansionary fiscal policy, it would bring the economy to

Assume that the economy initially has a price level of P1 and output level Q1. If the government implements expansionary fiscal policy, it would bring the economy to

A. P2 and Q4. B. P2 and Q2. C. P1 and Q1. D. P1 and Q3.

The prisoner's dilemma provides an explanation for

a. the price wars that sometimes occur in oligopolies b. the ability of firms in an oligopoly to extract the entire consumer surplus c. the collusive behavior that sometimes occurs in an oligopoly d. the failure of firms in non-competitive industries to maximize profits e. an irrational behavior that occurs in competitive markets

Which of the following economies has the highest ratio of Social Security benefits to GDP in 2006?

a. Germany b. Netherlands c. Canada d. France e. United States

An increase in European wealth, all other factors held constant should:

A. cause the demand for dollars to increase. B. have no impact at all on the demand for dollars. C. cause the supply of dollars to increase while the demand stays constant. D. cause the demand for dollars to decrease.