In the long run an increase in the marginal tax rate on asset income in the market clearing model:

a. increases GDP.

b. raises consumption.

c. decrease the capital stock.

d. all of the above.

Answer: c. decrease the capital stock.

You might also like to view...

What is the difference between microeconomics and macroeconomics?

What will be an ideal response?

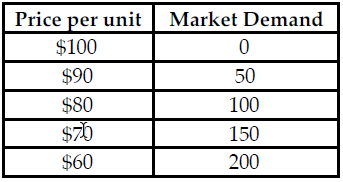

Refer to the table below. If this market is a Cournot Oligopoly and Firm X is produces 50 units, what is Firm Y's profit-maximizing quantity if their average total and marginal cost are constant and equal to $60?

The table above shows the market demand for a product that both Firm X and Firm Y manufacture. Both firms produce an identical product and the firms' average total and marginal cost are equal and constant.

A) 50 B) 100 C) 200 D) 150

If U.S. prices increase relative to the rest of the world, we would expect:

A. net exports to increase. B. net exports to decrease. C. net exports to be unaffected. D. government spending to increase.

Seasonal unemployment is

A. a result of the seasonal pattern of work in specific industries. B. a result of business recessions that occur when aggregate demand is insufficient to create full employment. C. due to the fact that workers must search for appropriate job offers. D. a result of a poor match of worker's abilities and skills with current requirements of employers.