Suppose that the bond market and the money market start out in equilibrium. Explain the process by which the interest rate and the price of bonds will change as a result of the Fed increasing the money supply

When the Fed increases the money supply (shifting the supply of money curve to the right), it creates a surplus of money. With this surplus of money, individuals will purchase more bonds, shifting the demand for bonds curve to the right. The result is a shortage of bonds at the original bond price, which will push up the price of bonds. As bond prices rise, interest rates fall, and that will occur in the money market. Eventually both markets are back in equilibrium.

You might also like to view...

The free-rider problem with a public good leads to

A) inefficiency if the good is provided by only private markets with no government action. B) overproduction if the good is provided by private markets. C) underproduction if the good is provided by the government. D) None of the above answers is correct.

Under the U.S. Constitution, each state gave up its right to issue money, borrow, levy taxes and regulate the value of money on behalf of national efforts

Indicate whether the statement is true or false

E. Carey Brown, an MIT economist, studied government deficits during the Great Depression and found that even though actual deficits were large, the structural deficit changed very little. Which of the following statements is consistent with this finding?

A. Fiscal policy did not work during the Depression. B. Fiscal policy made the Depression worse. C. Fiscal policy was not tried during the Depression. D. Fiscal policy improved the economy during the Depression.

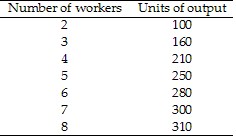

Refer to Table 10.1. The marginal product of the fifth unit of labor is:

Refer to Table 10.1. The marginal product of the fifth unit of labor is:

A. 8. B. 40. C. 50. D. 250.