Dr. Rand earns $420,000 per year. He is charged a 20% tax on the first $100,000 he earns. He is charged a 30% tax for any income he earns between $100,000 and $250,000, and he is charged a 38% tax on anything he earns over $250,000. How do we find his marginal tax rate?

a. Add 20% of $100,000, 30% of $150,000, and 38% of $170,000, and then divide the total by $420,000.

b. Look at the percentage rate he would pay on his last dollar of income, which is 38%.

c. Look at the percentage rate he would pay on $1, which is 20%.

d. Add 20%, 30%, and 38%, divide by three, and multiply that amount times $420,000.

b. Look at the percentage rate he would pay on his last dollar of income, which is 38%.

You might also like to view...

The congestion tax implemented in London reduced traffic volume and cut travel time for cars and buses in half

Indicate whether the statement is true or false

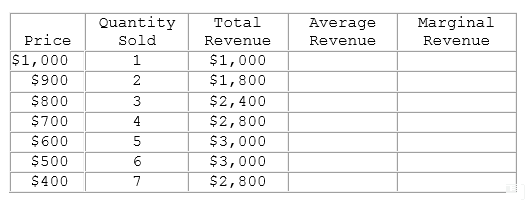

Using the information in the table shown, the marginal revenue:

This table represents the revenues faced by a monopolist.

A. increases, then decreases as output increases.

B. is negative after the 6th unit.

C. increases as output increases.

D. decreases, then increases after the 6th unit.

Too much of society's scarce resources are used to produce goods in monopoly markets

a. True b. False Indicate whether the statement is true or false

Other things being constant, if the U.S. real rate of interest exceeds that of its trading partners, we expect

A. an appreciation of U.S. currency. B. a worsening of the U.S. balance of payments. C. political instability in the United States. D. that a "dirty float" will emerge.