Suppose that at the beginning of a loan contract, the real interest rate is 4% and expected inflation is currently 6%. If actual inflation turns out to be 7% over the loan contract period, then

A) lenders gain 3% of the loan value. B) borrowers lose 3% of the loan value.

C) lenders gain 1% of the loan value. D) borrowers gain 1% of the loan value.

D

You might also like to view...

The aggregate demand curve is downward sloping because a higher price level induces producers to produce more

Indicate whether the statement is true or false

When considering trade of two goods between two people, if one person has all the endowment of both goods, this allocation

A) is never on a contract curve. B) will result in trade so each person has all of one good. C) will result in trade to a equal division of goods between the two people. D) is Pareto efficient.

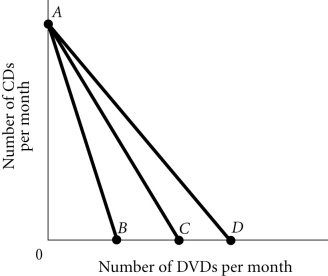

Refer to the information provided in Figure 6.3 below to answer the question(s) that follow. Figure 6.3Refer to Figure 6.3. Molly's budget constraint is AC. It would swivel to AD if the price of

Figure 6.3Refer to Figure 6.3. Molly's budget constraint is AC. It would swivel to AD if the price of

A. DVDs increased. B. CDs increased. C. DVDs decreased. D. CDs decreased.

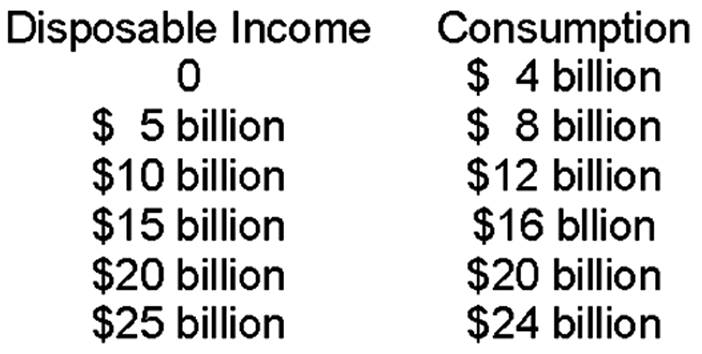

How much is autonomous consumption when disposable income is $15 billion?