In Citizens United, the Supreme Court struck down portions of the McCain-Feingold Act, which limited "electioneering communication" by corporations and unions because:

a. since there is no distinction between media and other corporations, such restrictions would allow Congress to suppress political speech in all media outlets

b. since there is no distinction between media and other corporations, such restrictions would not allowCongress to suppress political speech in all media outlets

c. since there is a distinction between media and other corporations, such restrictions would not allow Congress to suppress political speech in all media outlets

d. since there is no distinction between non-profit and for-profit corporations, such restrictions would allowCongress to suppress political speech in all corporations e. none of the other choices are correct

a

You might also like to view...

Susqua, Inc. has held-to-maturity debt securities it purchased in 2018. At December 31, 2019, Susqua, Inc. reported a $120,000 impairment loss related to these securities. During 2020, the debtor was successful in registering a new patent which improved the debtor's operating outlook. This change of events resulted in a reversal of $45,000 of the impairment loss. At December 31, 2020, the fair value of the debt securities had increased by $68,000 over the impaired value previously recorded. Susqua, Inc. uses IFRS for its external reporting. How much, if any, of this reversal can Susqua, Inc. report in its income for 2020?

A. $120,000. B. $68,000. C. $45,000. D. $ - 0 -

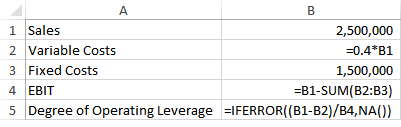

What should be the outcome of B6?

a) #DIV/0!

b) #N/A

c) 2.43

d) 2.10

e) 1.75

Which of the following groups is more likely according to research to engage in self-leadership strategies?

a. Young people b. Older people c. Middle-aged people d. Elderly people

When a new partner is admitted to a partnership, there should be a(n)

A) the total assets of the partnership increase B) new capital account is added to the ledger for the new partner C) the total owner's equity of the partnership increases D) the cash received by the current partner represents the amount of the debit to that partner's capital account.