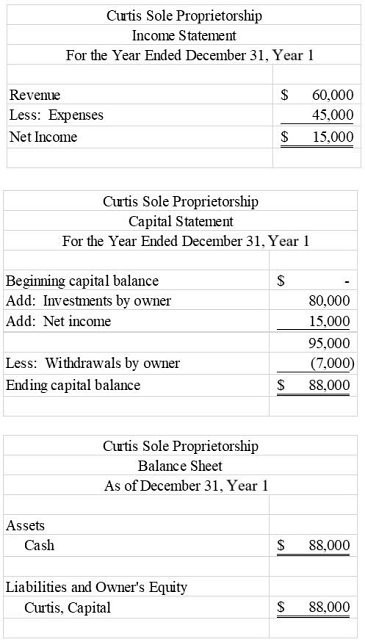

On January 1, Year 1, Charlotte Curtis started Curtis Company as a sole proprietorship with an initial investment of $80,000. During Year 1, the business earned $60,000 in cash revenue and paid $45,000 in cash expenses. During Year 1, Ms. Curtis withdrew $7,000 for her personal use. Required: Using the above information, prepare an income statement, a capital statement, and a balance sheet for the Curtis Company.

What will be an ideal response?

You might also like to view...

Which of the following budgets is used to provide an "apples to apples" comparison of budgeted and actual performance at the actual unit volume attained?

a. Continuous budget b. Flexible budget c. Master budget d. Static budget

________ stipulates that the contract is a complete integration and the exclusive expression of the parties' agreement

A) Promissory estoppel B) Merger clause C) Main purpose exception D) Leading object exception

If a company is managing its earnings, which of the ethical theories are they most likely following?

A. Fairness B. Egoism C. Rights D. Virtue

The amount of the depreciation tax shield can be calculated by multiplying the amount of depreciation expense by the tax rate.

Answer the following statement true (T) or false (F)