A financial services consulting company bought an office building for $900,000. The company has 10 professional staff members. Monthly expenses for salaries, utilities, grounds maintenance, etc. are $1.1 million. The average billing rate per professional is $90 per hour. Use an interest rate of 1% per month and assume the building will have a re-sale value of $1.5 million after 10 years. (a) How many hours per month must be billed in order to make a profit of $15,000 per month? (b) How many hours per professional per month must be billed? (c) There are 260 eight-hour workdays per year. Of the total work hours available per month, what percentage does the hours per professional in part (b) represent?

What will be an ideal response?

(a) Let x = hours per month billed to breakeven

15,000 = -900,000(A/P,1%,120) – 1,100,000 + 1,500,000(A/F,1%,120) + 10(90)x

15,000 = -900,000(0.01435) – 1,100,000 + 1,500,000(0.00435) + 10(90)x

900x = 1,121,390

x = 1246 hours/month

(b) Billable hours per professional = 1246/10 = 124.6 hours

(c) Total hours per month = 260(8)/12 = 173.3

Billable percent = 124.6/173.3

= 0.719 (72%)

You might also like to view...

Which of the following is NOT a leading cause of accidents on the job?

A) Unsafe behavior B) Human error C) Management failures D) Industrial hygiene

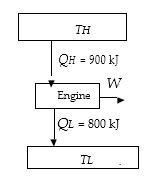

The efficiency of the heat engine sketched in the figure is nearest

A) 11%

B) 18%

C) 22%

D) 33%

Draw a traverse from the calculations and information shown in Figure 7–26.

What will be an ideal response?

The most common DS-3 framing format used today is:

A) ESF B) C-bit parity C) clear channel D) M23