Assume that foreign capital flows from a nation increase due to political uncertainly and increased risk. If the nation has highly mobile international capital markets and a fixed exchange rate system, what happens to the quantity of real loanable funds and monetary base in the context of the Three-Sector-Model?

a. The quantity of real loanable funds rises and monetary base rises

b. The quantity of real loanable funds rises and monetary base falls.

c. The quantity of real loanable funds falls and monetary base falls.

d. The quantity of real loanable funds and monetary base remain the same.

e. There is not enough information to determine what happens to these two macroeconomic variables.

.C

You might also like to view...

A strike, or the threat of one, is most likely to be effective when

a. demand for the firm's product is strong. b. foreign competition for the product is high. c. the firm has a high product inventory. d. demand for the product produced by the union workers is highly elastic.

Suppose the actual equilibrium federal funds rate is below the rate implied by a particular inflation goal. In this situation, the Taylor rule implies that

A. fiscal policy is contractionary. B. monetary policy is contractionary. C. fiscal policy is expansionary. D. monetary policy is expansionary.

The ________ is an example of a regressive tax.

A. energy tax B. tariff C. sales tax D. individual income tax

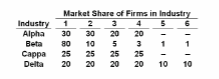

Refer to the table. The government would likely challenge a merger between:

Answer the question on the basis of the following table showing market shares of firms in hypothetical industries. Assume these are distinct industries with no buyer-seller relationships or competition among them.

A. Firm 1 in Alpha and Firm 6 in Delta.

B. Firms 3 and 4 in Beta.

C. Firms 1 and 2 in Cappa.

D. Firm 4 in Alpha and Firm 3 in Cappa.