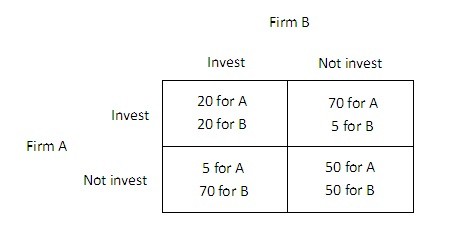

The payoff matrix below shows the payoffs (in millions of dollars) for two firms, A and B, for two different strategies, investing in new capital or not investing in new capital.  An industry spy comes to firm B and claims to know what firm A has decided. Given that each firm already knows the payoff matrix, how much would this information be worth to firm B?

An industry spy comes to firm B and claims to know what firm A has decided. Given that each firm already knows the payoff matrix, how much would this information be worth to firm B?

A. $30 million.

B. $0.

C. $70 million.

D. $50 million.

Answer: B

You might also like to view...

If a pre -merger Herfindahl-Hirschman Index (HHI) is between ________, the market is considered moderately competitive and if a merger in this market raises the HHI by more than ________, antitrust agencies worry about the potential loss of competition.

A) 1,500 and 2,500; 50 B) 2,500 and 5,500; 100 C) 2,500 and 5,500; 25 D) 1,500 and 2,500; 100

A dominant strategy:

A. exists in every game. B. is the best one to follow no matter what strategy other players choose. C. is always the same for all players of a game. D. awards the highest achievable payoff in a game.

The balance of trade is the value of:

A. exports minus the value of imports. B. imports minus the value of exports. C. total goods purchased by the U.S. from abroad. D. total goods sold by the U.S. to parties abroad.

The desire for carrots changes as one moves down the demand curve for carrots.

Answer the following statement true (T) or false (F)