In the Social Security system, the tax receipts from today's workers are

A. paid into the federal government's general revenue to be used for any government expenditure.

B. paid into an account in the employee's name and saved and invested for that individual until he or she retires.

C. all paid into Medicare.

D. used to pay benefits to retired and disabled workers and their dependents today.

Answer: D

You might also like to view...

What are the differences and similarities between a depreciation and devaluation of a currency?

What will be an ideal response?

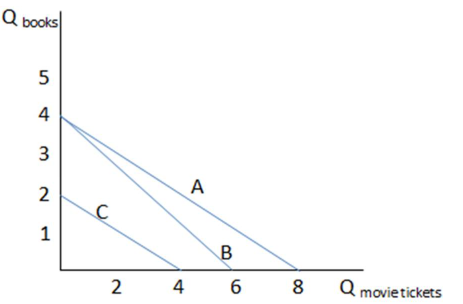

Assume Bryce's budget constraint is represented by line C in the graph shown. Which of the following would cause Bryce's budget constraint to shift to A?

A. Bryce's income increased.

B. Bryce's income decreased.

C. Bryce's preferences for books and movies decreased.

D. Bryce's preferences for books and movies increased.

A tax on a product causes a deadweight loss because: a. some consumer surplus is transferred from buyers to producers

b. some producer surplus is transferred from producers to consumers. c. some consumer and producer surplus is transferred to the government. d. it distorts the incentives of producers and consumers so that the efficient level of output is not produced.

The U.S. government will probably return soon to a system of paper money backed by gold

a. True b. False Indicate whether the statement is true or false