Suppose that the marginal propensity to consume is 0.75

a. If the government decreases spending by $500 billion, what is the change in output?

b. If the government decreases taxes by $500 billion, what is the change in output?

c. If the government decreases transfer payments by $500 billion, what is the change in output?

d. If the government decreases spending by $500 billion and at the same time decreases taxes by $500 billion, what is the change in output?

If the MPC = 0.75, the autonomous expenditure multiplier = 1 / (1 - 0.75 ) = 4.

If the MPC = 0.75, the tax multiplier = -0.75 / (1 - 0.75 ) = -3.

If the MPC = 0.75, the transfer payment multiplier = 0.75 / (1 - 0.75 ) = 3.

a. If the government decreases spending by $500 billion, output will decrease by $500 billion × 4 = $2 trillion.

b. If taxes are decreased by $500 billion, output will increase by -$500 billion × -3 = +$1.5 trillion.

c. If transfer payments are decreased by $500 billion, output will decrease by $500 billion × 3 = $1.5 trillion.

d. If the government decreases spending by $500 billion at the same time as decreasing taxes by $500 billion, output will change by (-$500 billion × 4 ) + (-$500 billion × -3 ) = -$500 billion )a decrease of $500 billion), the same amount as the initial decrease in government spending.

You might also like to view...

If a good is not produced, then there is no demand for it

Indicate whether the statement is true or false

A by-product of the acceptance of the Keynesian school was the wide approval and practice of activist government fiscal policy around the world

a. True b. False Indicate whether the statement is true or false

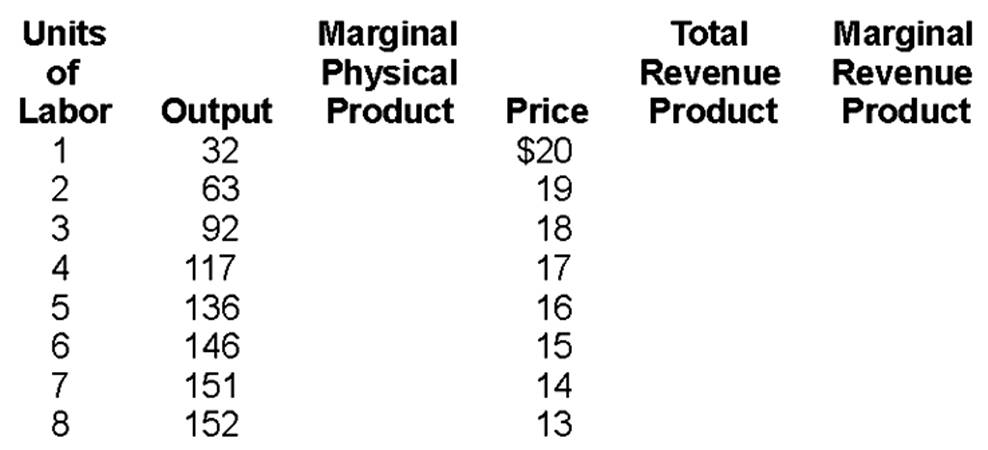

How many workers would the firm hire if the wage rate were $459?

Suppose consumers save 8 percent of their incomes. If the government collects 4 dollar in taxes from each taxpayer and invested it in infrastructure, total social investment will ________ per taxpayer.

A. increase by $ 4.32 B. increase by $3.68 C. increase by 32 cents D. decrease by 64 cents