Consider an open economy that is a net borrower (like the United States). What would be the impact of a shift to a closed economy?

A) domestic interest rates would decline

B) domestic savings would decline

C) domestic investment would decline

D) net borrowing would increase

C

You might also like to view...

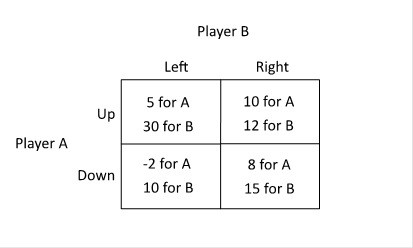

Refer to the figure below. In this game, how many dominant strategies does Player B have?

A. 0 B. 4 C. 2 D. 1

We are investigating the relationship among three variables. We have graphed two of them. Suppose that the variable that is not measured on the x-axis or the y-axis changes. Then, there is

A) no impact on the plotted curve because the variable is not measured on either of the axes. B) a violation of the absence of trend assumption. C) a shift in the plotted curve. D) a movement along the plotted curve. E) an omitted variable.

What happened to real interest rates during the early 1930s?

A) They declined as nominal interest rates declined. B) They rose as nominal interest rates rise. C) They declined due to deflation. D) They rose due to deflation.

A firm that has a great deal of control over the price of a good is said

A) to function in a black market. B) to create an externality. C) to have monopoly power. D) to be in an antitrust position.