Budgeting supports the planning process by encouraging all of the following activities except:

A) requiring all organizational units to establish their goals for the upcoming period

B) increasing the motivation of managers and employees by providing agreed-upon expectations

C) directing and coordinating operations during the period

D) improving overall decision making by considering all viewpoints, options, and cost reduction possibilities

C

You might also like to view...

When bonds held as long-term investments are purchased at a price other than the face value, the premium or discount should be amortized over the remaining life of the bonds

a. True b. False Indicate whether the statement is true or false

List three pros of an assumable loan

What will be an ideal response?

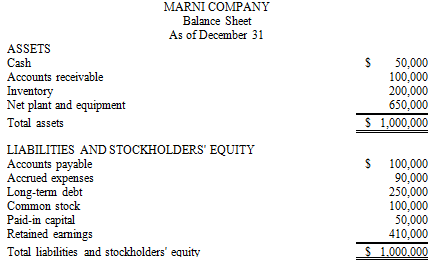

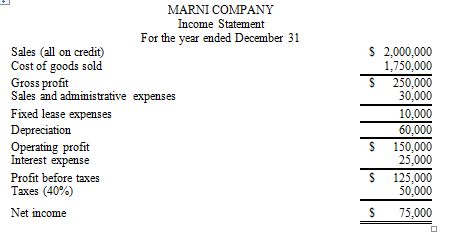

Refer to the tables above. What is Marni's total asset turnover?

A) 13.3x

B) 4x

C) 1x

D) 2x

Bartow Corporation uses an activity based costing system to assign overhead costs to products. In the first stage, two overhead costs--equipment expense and indirect labor--are allocated to the three activity cost pools--Processing, Supervising, and Other--based on resource consumption. Data to perform these allocations appear below:Overhead costs: Equipment expense$29,000Indirect labor$8,000 Distribution of Resource Consumption Across Activity Cost Pools: Activity Cost Pools ProcessingSupervisingOtherEquipment expense0.200.600.20Indirect labor0.500.300.20 In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to

products. Activity data for the company's two products follow:Activity: MHs (Processing)Batches (Supervising)Product H36,700700Product O53,3001,300Total10,0002,000 How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation? A. $7,400 B. $9,800 C. $5,800 D. $4,000