Why does a tax create a greater deadweight loss with an elastic supply or demand curve?

What will be an ideal response?

Other things being equal, the more elastic the demand or the supply curve, the larger the deadweight loss, because a given tax reduces the quantity exchanged by a greater amount. Elasticity measures responsiveness to changes in price, so the more elastic the curves are, the greater the change in output and the larger the deadweight loss (i.e., fewer mutually beneficial transactions).

You might also like to view...

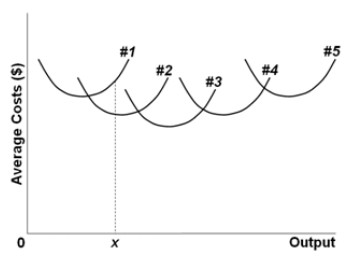

Use the following graph to answer the next question. The diagram shows the short-run average total cost curves for five different plant sizes of a firm. If in the long run the firm should produce output 0x, it should do it with a plant of size

The diagram shows the short-run average total cost curves for five different plant sizes of a firm. If in the long run the firm should produce output 0x, it should do it with a plant of size

A. #4. B. #3. C. #2. D. #1.

Suppose the First National Bank acquires $500,000 in new deposits and the required reserve ratio is 12 percent. Which of the following is true?

a. Required reserves on the new deposits are $12,000. b. Excess reserves on the new deposits are $500,000. c. Required reserves on the new deposits are $60,000. d. Excess reserves on the new deposits are $12,000. e. Total reserves on the new deposits are $440,000.

Suppose an airline determines that its customers traveling for business have inelastic demand and its customers traveling for vacations have an elastic demand. If the airline's objective is to increase total revenue, it should

a. increase the price charged to vacationers and decrease the price charged to business travelers. b. decrease the price charged to vacationers and increase the price charged to business travelers. c. decrease the price to both groups of customers. d. increase the price for both groups of customers.

Suppose a consumer with an income of $100 is faced with Px = 1 and Py = 1/2. What is the market rate of substitution between good X (horizontal axis) and good Y (vertical axis)?

A. -1.0 B. -2.0 C. -4.0 D. 0.50