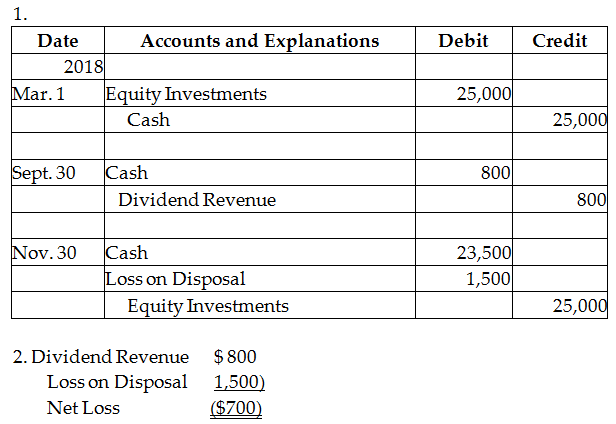

On March 1, 2018, Rawlins Company invests $25,000 in Ashton Company stock. Ashton pays Rawlins a $800 dividend on September 30, 2018. Rawlins sells the Ashton stock on November 30, 2018 for $23,500. Assume the investment is categorized as a short-term equity investment and that Rawlins does not have significant influence over Ashton.

Requirements:

1. Journalize the transactions for Rawlins' investment in Ashton's stock.

2. What was the net effect of the investment on Rawlins' net income for the year ended December 31, 2018.

You might also like to view...

The financial statements of an organization reflect a set of management assertions about the financial health of the business. All of the following describe types of assertions except

a. that all of the assets and equities on the balance sheet exist b. that all employees are properly trained to carry out their assigned duties c. that all transactions on the income statement actually occurred d. that all allocated amounts such as depreciation are calculated on a systematic and rational basis

In a statement of cash flows, which of the following would increase reported cash flows from operating activities using the direct method?

a. Collection of a note receivable b. Dividends received from investments c. Gain on purchase of treasury stock d. Gain on sale of equipment

Traditionally, overhead has been assigned based on direct labor hours or machine hours. What effect does this have on the cost of a high-volume item?

a. over-costs the product b. under-costs the product c. has no effect the product cost d. cost per unit is unaffected by product volume

The buyer will include the sales tax as part of the cost of merchandise purchased

Indicate whether the statement is true or false