After auditing Jayne Morgan's 2017 Form 1040, the IRS assessed a $19,900 deficiency of income tax. Jayne's return reported $218,000 tax so, her correct 2017 income tax was $237,900 ($19,900 deficiency + $218,000 reported tax). Compute Jayne's penalty for a substantial understatement of income tax.

A. $2,980

B. $3,980

C. $5,000

D. $0

Answer: D

You might also like to view...

The executive summary is usually at the very beginning of a research proposal

Indicate whether the statement is true or false

Compare and contrast generalized leader behavior and decision-making leader behavior.

What will be an ideal response?

The length of the investment in a foreign country has no impact on the risk assessment for that investment. What matters are the economic and political situations in the country.

Answer the following statement true (T) or false (F)

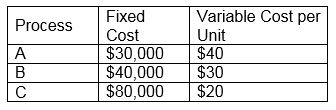

ABC Corporation would like to evaluate three production processes (A, B, and C) to accommodate the changes in demand for its products. The fixed and variable costs per unit are tabled here. Determine the process to be selected when the production volume is 500 units.

A. Process A

B. Process B

C. Process C

D. cannot be determined