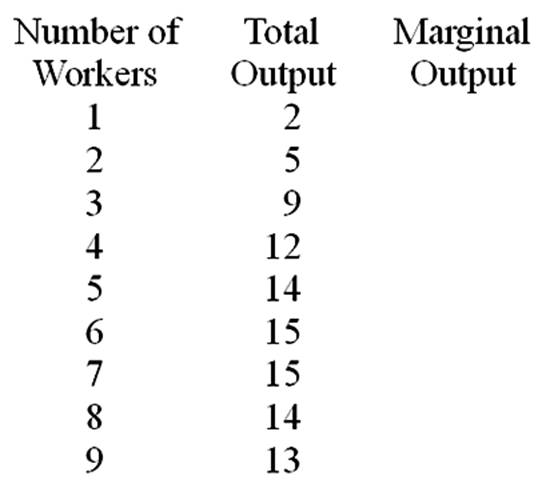

Negative returns set in with the _____ worker.

8th

You might also like to view...

Sammy has a drone that he values at $1,500. Dean values the same drone at $2,000. Sammy decides to sell the drone to Dean for $1,800. If the government imposes a $250 tax on the sale of drones,

A) Sammy and Dean would not be able to complete the transaction. B) Sammy and Dean would still be able to complete the transaction. C) the tax would cause a deadweight loss of $500. D) Both A and C are correct.

Outline the various actions the government sector could take to promote growth

What will be an ideal response?

According to the assumption of consumer rationality, a consumer who prefers one head of broccoli to one head of cauliflower, one head of cauliflower to one package of brussel sprouts, and one

a. package of brussel sprouts to one head of cabbage, must prefer a head of cabbage to a head of cauliflower b. package of brussel sprouts to one head of cabbage, must prefer a head of broccoli to any other vegetable c. package of brussel sprouts to one head of cabbage, must prefer a package of brussel sprouts to a head of cauliflower d. package of brussel sprouts to one head of cabbage, must prefer a head of cauliflower to a head of cabbage e. head of cabbage to one package of brussel sprouts, must prefer the package of brussel sprouts to a head of broccoli

When dealing with externalities, how can we correct market failure?

a) In the case of negative externalities, the market can correct it, but in the case of positive externalities, government regulation is necessary. b) In the case of positive externalities, the market can correct it, but in the case of negative externalities, government regulation is necessary. c) In the case of both positive and negative externalities, market can correct all market failures. d) In the case of both positive and negative externalities, government regulation is necessary to induce market participants to internalize the externality.