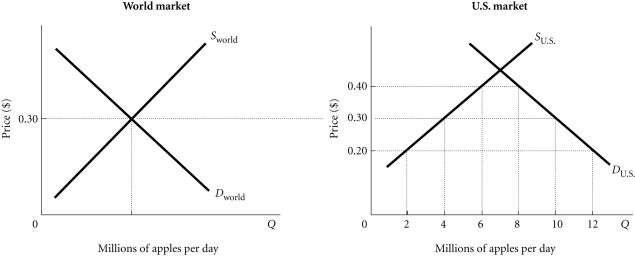

Refer to the information provided in Figure 4.1 below to answer the question(s) that follow. Figure 4.1Refer to Figure 4.1. If the United States levies no taxes on apples, the price of apples in the United States would fall to ________, and the United States would import ________.

Figure 4.1Refer to Figure 4.1. If the United States levies no taxes on apples, the price of apples in the United States would fall to ________, and the United States would import ________.

A. 20 cents per apple; 10 million apples per day

B. 30 cents per apple; 6 million apples per day

C. 40 cents per apple; 2 million apples per day

D. The price of apples in the United States after the U.S. government eliminated all taxes on imported apples cannot be determined from this information.

Answer: B

You might also like to view...

The circular flow of income shows that

A) households transact only in the goods market. B) governments purchase goods and services. C) firms generally are the demanders in the goods markets and suppliers in the factor markets. D) None of the above answers is correct.

Giorgio wants to build a new distribution warehouse for his sporting goods business and is going to issue new shares of stock to do so. This is an example of using ________ for his building project

A) indirect finance B) direct finance C) dividends D) retained earnings

The marginal propensity to consume is the slope of the consumption function

Indicate whether the statement is true or false

Producer surplus refers to

a. the difference between the market price for a good and the minimum price the producer would accept b. the difference between the market price for a good and the maximum price a consumer would be willing to pay c. the excess supply a firm produces for the market d. the profit a producers receives for a good e. the difference between consumer surplus and the price of the good