If the government wants to raise tax revenue and shift most of the tax burden to the consumers, it would impose a tax on a good with a:

a. flat (elastic) demand curve and a steep (inelastic) supply curve.

b. steep (inelastic) demand curve and a flat (elastic) supply curve.

c. steep (inelastic) demand curve and steep (inelastic) demand curve.

d. flat (elastic) demand curve and a flat (elastic) supply curve.

b

You might also like to view...

Which of the following can be considered an example of cyclical unemployment?

a. A recent graduate searching for his first job b. A ski instructor looking for a part-time job during the summer c. An engineer looking for a new job after losing his job during a recession d. A typist looking for a new job as his skills are not needed in the current labor market

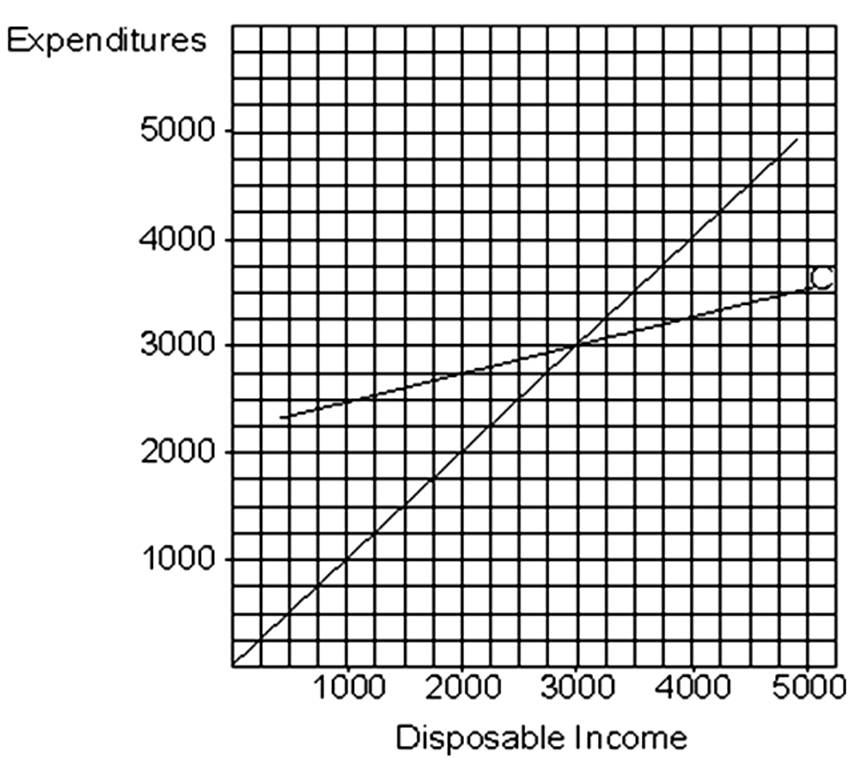

In this graph, when disposable income is 4,000, savings is

A. 4,000.

B. 3,000.

C. 2,500.

D. 750.

If society decides it wants more of one good and ________, then it has to give up some of another good and incur some opportunity costs

A) technology advances B) resources are underutilized C) all resources are fully utilized D) new resources are discovered

A surplus in a country's balance of trade occurs whenever the country

A. has money outflows that exceed its money inflows. B. refrains from trade with OPEC countries. C. exports more goods than it imports. D. imports more financial capital than it exports.