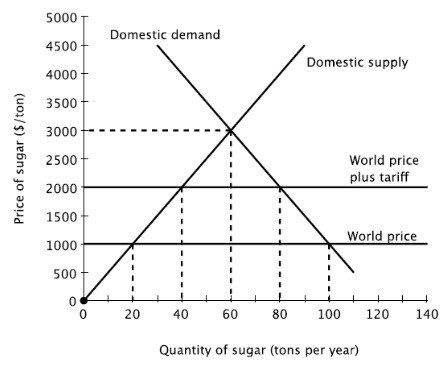

The amount of revenue the government collects after imposing the tariff is ________.

A. $1,000

B. $40,000

C. $10,000

D. $4,000

Answer: B

You might also like to view...

The government raises gasoline taxes as part of the price of gasoline and receives more tax revenues. However, after five years, the government discovers that revenues from the gasoline tax have declined

This situation would be most likely to occur if A) the long-run elasticity of supply was much greater than the long-run elasticity of demand. B) the demand for gasoline was inelastic in the short run, but elastic in the long run. C) the long-run elasticity of demand was greater than the long-run elasticity of supply. D) the demand for gasoline was perfectly inelastic in both the short run and the long run.

An increase in the market price of a good increases consumer surplus

a. True b. False Indicate whether the statement is true or false

How did the European Union attempt to alleviate problems with currency exchange among its member countries?

a. removed trade barriers b. created a common currency c. dissolved national banks d. eliminated national borders

Health care:

A. is an inferior good. B. is a normal good. C. is highly elastic with respect to price. D. has a price elasticity of demand of 1.