How is the public debt calculated?

a. By adding up consumption, investment, government purchases, and net exports and then cumulating the annual totals over the years of the nation

b. By subtracting consumption and investment from government spending each year and then cumulating the annual totals over the years of the nation

c. By subtracting current government spending from current government tax revenues

d. By adding up the difference between annual government tax revenues and annual government spending and cumulating the differences over the years of the nation

d. By adding up the difference between annual government tax revenues and annual government spending and cumulating the differences over the years of the nation

You might also like to view...

Why is the indifference curve convex or bowed inward?

A. As you consume more of one good you are willing to give up less of the other good. B. As you consume less of one good you are willing to give up less of the other good. C. As you consume more of one good you are willing to give up more of the other good. D. As you consume more of one good you are willing to give up half of the other good.

You hold currency from a foreign country. If that country has a higher rate of inflation than the United States, then over time the foreign currency will buy

a. more goods in that country and buy more dollars. b. more goods in that country but buy fewer dollars. c. fewer goods in that country but buy more dollars. d. fewer goods in that country and buy fewer dollars.

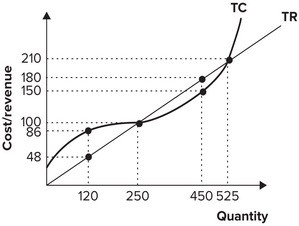

Refer to the graph shown. To maximize profit, this firm should produce:

A. 250 units of output. B. 525 units of output. C. 450 units of output. D. 120 units of output.

An externality exists when the cost or benefit resulting from some activity or transaction is experienced by parties external to the activity or transaction.

Answer the following statement true (T) or false (F)