Solve the problem.Daniel earns $125,448 annually and is paid monthly. How much Social Security tax will be deducted from his December earnings? How much Medicare tax will be deducted from his December earnings? Social security tax is 6.2% and Medicare tax is 1.45%. Round to the nearest cent.

A. Social Security tax = $21.74

Medicare tax = $15.16

B. Social Security tax = $218.37

Medicare tax = $152.58

C. Social Security tax = $217.37

Medicare tax = $151.58

D. Social Security tax = $2173.70

Medicare tax = $1515.83

Answer: C

Mathematics

You might also like to view...

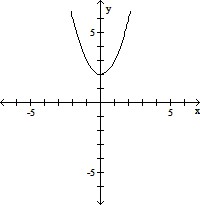

Use the graph of a known basic function and a combination of horizontal shifts, reflections, and vertical shifts to sketch the function.f(x) = -x2 + 2

A.

B.

C.

D.

Mathematics

Find the exact function value.tan-1

A. -

B. -1

C. 0

D. 1

Mathematics

Find the center and the radius of the circle.6x2 + 6y2 = 36

A. center (0, 0), radius =

B. center (6, 6), radius =

C. center (0, 0), radius = 6

D. center (0, 0), radius = 36

Mathematics

Find the absolute value of the number.?0?

A. does not exist B. 0

Mathematics