The more rapidly the government creates money to finance its budget deficits, the:

A. smaller the inflation tax and the greater the reduction in the real value of any assets specified in nominal terms.

B. smaller the inflation tax and the smaller the reduction in the real value of any assets specified in nominal terms.

C. greater the inflation tax and the smaller the reduction in the real value of any assets specified in nominal terms.

D. greater the inflation tax and the greater the reduction in the real value of any assets specified in nominal terms.

Answer: D

You might also like to view...

A theory can best be defined as

A. an untested assertion of untested fact. B. a set of assumptions that simplify the real world. C. the opinion of a reliable person who studies a subject or discipline. D. a deliberate simplification of factual relationships that attempts to explain how those relationships work. E. the accumulation of knowledge that has been verified by the scientific community.

Explain the difference between the GDP deflator and the Consumer Price Index

What will be an ideal response?

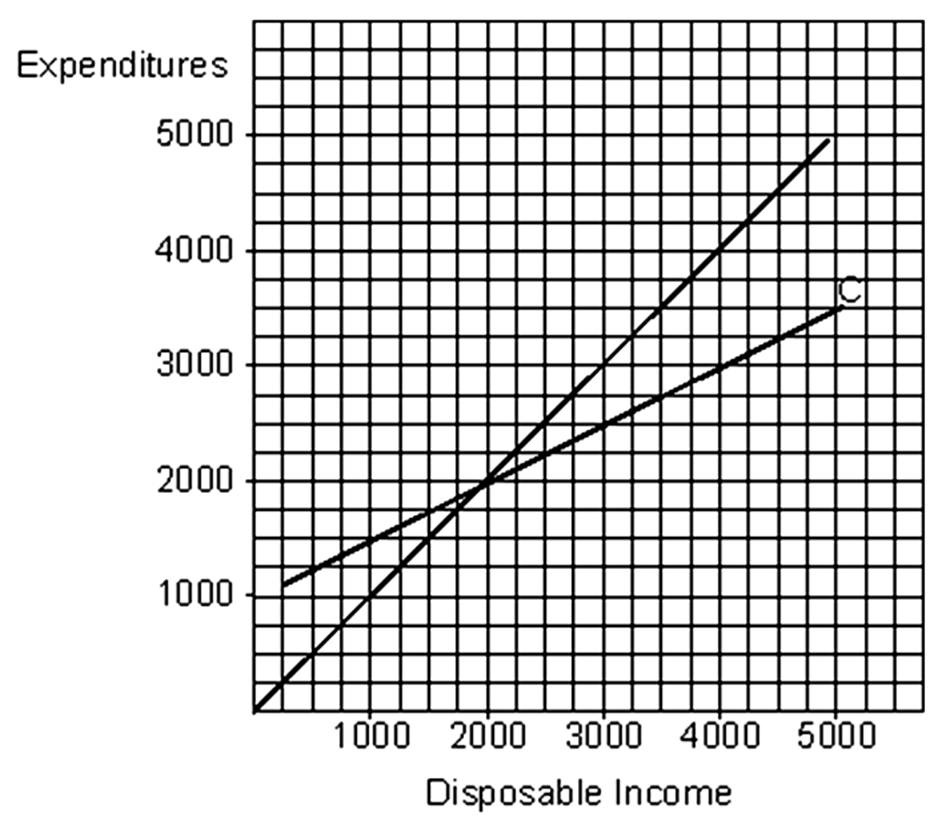

In this graph, when disposable income is 3,000, consumption is

A. 2,000.

B. 2,500.

C. 3,000.

D. 3,500.

The money multiplier is calculated as 1 / reserve requirement multiplied by the:

A. change in excess reserves following a change in the money supply. B. change in deposits following a change in government expenditure. C. change in total reserves following a change in the money supply.