The Laffer curve suggests that if tax rates get too _____, the government's tax revenues will _____.

A. high; fall

B. high; rise

C. low; fall

D. low; rise

A. high; fall

You might also like to view...

Which among the following will happen if the Fed buys bonds from a private bank?

A) The private bank's total assets will decrease. B) The Fed's total assets will decrease. C) The private bank's total assets will increase. D) The Fed's total liabilities will increase.

By donating $1,000 to the Salvation Army, Caroline reduces her taxable income. To Caroline, the reduction in her taxable income is

A) an incentive. B) an opportunity cost. C) the margin. D) a marginal benefit. E) a marginal cost.

Considering capital, marginal factor cost is defined as the

a. extra output produced by employing one more unit of capital (or loanable funds) b. extra total cost attributed to employing one more unit of capital (or loanable funds) c. contribution of capital (or loanable funds) to the final product d. change in capital (or loanable funds) required to produce one more unit of output e. change in total revenue contributed by an extra unit of capital (or loanable funds)

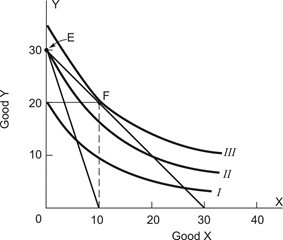

The consumer faces a budget constraint because the market price of X is $3, the market price of Y is $3, and the consumer's budget is $90. In order for this consumer to choose the corner solution at point E, which of the following must occur?

A. price of Y must rise to $6. B. price of X must rise to $6. C. price of Y must rise to $9. D. price of X must rise to $9.