Winnebago Industries Inc. reports the following selected information for its fiscal year ended August 25, 2018

Winnebago Industries Inc. reports the following selected information for its fiscal year ended August 25, 2018 ($ thousands).

| Contributed capital, August 26, 2017 | $106,289 |

| Treasury stock, August 26, 2017 | (342,730) |

| Retained earnings, August 26, 2017 | 679,138 |

| Accumulated other comprehensive (loss) income, August 26, 2017 | (1,023) |

During fiscal year 2018, Winnebago reported the following:

| 1. Issuance of stock | $ 5,822 |

| 2. Repurchase of stock | 4,644 |

| 3. Net income | 102,416 |

| 4. Cash dividends | $12,738 |

| 5. Other comprehensive income/ (loss) | 1,915 |

Use this information to prepare the statement of stockholders' equity for Winnebargo's for fiscal year August 25, 2018.

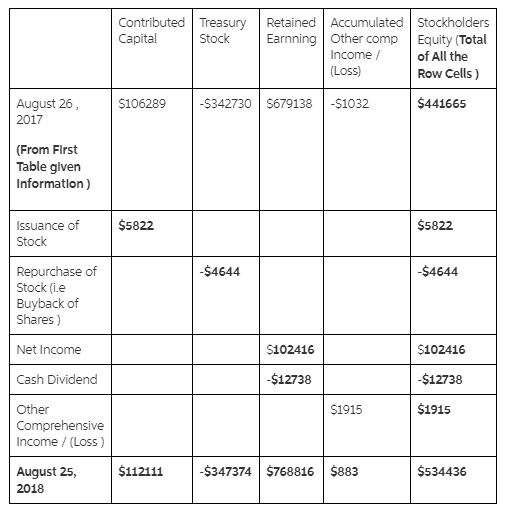

Ans: Preparation of Statement of Stockholders Equity for Fiscal Year August 25, 2018

Notes

1) On issue of Shares or Stock , Stock Captial will be increase there by increasing Cash , entry for Same is

Cash at Bank Dr $5822

To Share Capital Cr $5822

(Being Issue of Share Capital )

2) Treasury Stock or Share , are the portion of Shares that company keeps in its own treasury . When Business Buyback its owns shares it Become Treasury Stock, Entry for the sames will be

Tresury Stock Dr $4644

To Cash at bank $4644

(Being Repurchase or Buyback of Stock )

3) Net income on closing will goes to retained earning as a part in Financial Statement . hence will come under reatined earning in Statement of Shareholders Equity .

4) Dividend are the income of the shareholders which are paid out of Current year Income or Past year accumulated Income , and ultimately payment of Dividend will cause Reduction in Retained Earning .

5) Other Comprehensive income or losses are the gain , losses , Revenue that is yet to realised , as this are yet to part of Retained earning and as per Standards it has to be shown seperately .

You might also like to view...

You believe that a corporation's dividends will grow 5% on average into the foreseeable future. If the company's last dividend payment was $5 what should be the current price of the stock assuming a 12% required return?

What will be an ideal response?

Explain Microsoft Windows' monopoly positions in terms of network externalities

What will be an ideal response?

A firm that finds it extremely expensive to monitor the output of each worker will likely pay its workers

A. according to how much each worker produces. B. with incentive pay. C. with time rates. D. on commission. E. with piece rates.

"Consumer sovereignty" refers to the:

A. fact that resource prices are higher than product prices in capitalistic economies. B. idea that the pursuit of self-interest is in the public interest. C. idea that the decisions of producers must ultimately conform to consumer demands. D. fact that a federal agency exists to protect consumers from harmful and defective products.