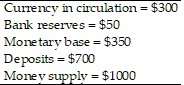

Consider an economy that has the following monetary data. The monetary base and the money supply are expected to grow at a constant rate of 20% per year. Inflation and expected inflation are 20% per year. Suppose that bank reserves and currency pay no interest, all currency is held by the public, and bank deposits pay no interest.(a)What is the cost to the public of the inflation tax?(b)What is the nominal value of seignorage over the year?(c)What is the profit to the banks from the inflation?

The monetary base and the money supply are expected to grow at a constant rate of 20% per year. Inflation and expected inflation are 20% per year. Suppose that bank reserves and currency pay no interest, all currency is held by the public, and bank deposits pay no interest.(a)What is the cost to the public of the inflation tax?(b)What is the nominal value of seignorage over the year?(c)What is the profit to the banks from the inflation?

What will be an ideal response?

| (a) | $200 |

| (b) | $70 |

| (c) | $130 |

You might also like to view...

According to the text, the price elasticity of demand for oranges has been estimated to be -0.62. This implies that a doubling of the price of oranges would cause the quantity demanded of oranges to:

A) increase by 6.2 percent. B) decrease by 6.2 percent. C) increase by 62 percent. D) decrease by 62 percent.

Identify the correct statement

a. Aggregate demand alone determines equilibrium price and output. b. Aggregate supply alone determines equilibrium price and output. c. Aggregate demand and aggregate supply determine equilibrium price and output. d. Aggregate demand shows the positive relationship between price level and real GDP. e. Aggregate supply shows the negative relationship between price level and real GDP.

A rightward shift of the investment demand curve would be caused by a(n):

A. increase in the expected rate of return on investment caused by an increase in business confidence. B. decrease in the expected rate of return on investment caused by a decrease in business confidence. C. increase in the rate of interest. D. decrease in the rate of interest.

Distinguish the concepts of comparative advantage and absolute advantage

What will be an ideal response?