In the current year, Martha makes the transfers below to her husband, Ryan. What is the amount, if any, of her marital deduction?

a) In August, she gives him a house valued at $250,000.

b) In December, she gives him a 15-year income interest in a trust with the bank name as trustee. She names her son as the remainderman. The trust is irrevocable and is funded with $500,000 of assets, and 8% is the applicable interest rate.

a) The marital deduction is $235,000 ($250,000 - $15,000 exclusion).

b) No marital deduction is available because the transfer is of a nondeductible terminable interest. The property passes to the daughter at the end of 15 years.

You might also like to view...

Define strategic positioning. Explain the three principles that underlie strategic positioning.

What will be an ideal response?

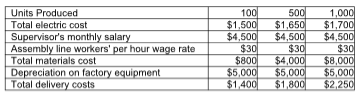

Identify each cost below as variable (V), fixed (F), or mixed (M), relative to units sold. Explain the reason for your answer.

The cultural dimension in which organizations encourage and reward members for excellence is ______.

A. humane orientation B. assertiveness C. power distance D. performance orientation

IBM's Watson uses ________ or the ability of a computer system to understand spoken human language.

A. extreme questioning B. spatial analysis C. natural language processing (NLP) D. context clues E. common sense