In June 2008, $1 bought 104 yen and in October, $1 bought 93 yen. This change means

A) U.S. exports became more expensive for Japanese buyers.

B) there will be a movement down along the demand curve for dollars.

C) there was an increase in the value in the dollar, relative to the yen.

D) the dollar appreciated relative to the yen.

B

You might also like to view...

There were initially two satellite radio providers in the U.S. market, Sirius and XM Radio. The firms merged to form one firm, and the federal government did not challenge the merger

Although the merger created a single seller in this market, the existence of a monopoly may not have much impact on U.S. consumers. Which of the following statements are plausible reasons for the limited impact of the merger? A) There are very large fixed costs in providing satellite radio, and the industry may be a natural monopoly. One seller may be able to operate at lower cost than two sellers. B) Although there will only be one seller of satellite radio, there are other forms of radio broadcasts available to U.S. consumers and demand for satellite radio may be relatively elastic. C) The merged firm will operate at higher capacity and may be able to reduce costs through economies of scale and perhaps learning-by-doing, which will benefit U.S. consumers. D) all of the above

Characteristics of a perfectly competitive market include:

A. the absence of transaction costs. B. differentiated products. C. few sellers, some with a large market share. D. All of these are characteristics of a perfectly competitive market.

Two goods must have infinite cross elasticities to be considered as belonging to the same market

Indicate whether the statement is true or false

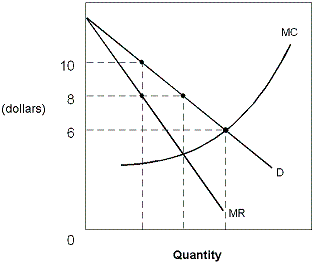

Exhibit 9-7 Monopolist

?

A. $8 to $6. B. $10 to $8. C. $10 to $6. D. $6 to $8.