If investors begin to perceive that government bonds being sold to finance a deficit have become more risky, the deficit will increase due to the change in interest payments.

Answer the following statement true (T) or false (F)

True

You might also like to view...

Evidence suggests that, following some exogenous shock, exchange rates change

A) before prices change. B) after prices change. C) at the same time prices change. D) None of the above.

If the Federal Reserve sells $1,500 in bonds and the resulting money supply change is $7,500, what is the required reserve ratio?

a. 5.0 b. 0.2 c. 0.1 d. 0.4 e. 0.8

Federal deficits had become pretty much an annual event during the 25-year period 1970–1995 . Deficits occur when

a. government spending is greater than tax revenue b. government spending equals tax revenue c. government spending is less than tax revenue d. government surpluses are taxed e. the national debt is reduced

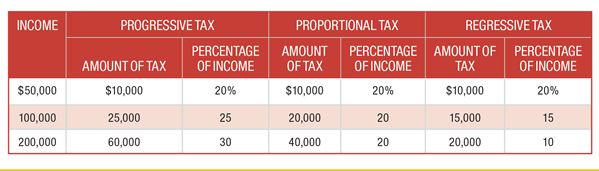

Based on the table demonstrating three tax systems, with these tax rates, which system(s) would bring in the lowest total revenue?

a. progressive

b. proportional

c. regressive

d. both regressive and proportional