When PepsiCo's management was considering the divestiture of a group of fast-food restaurant businesses (KFC, Pizza Hut, and Taco Bell), the following question was most likely asked:

A. "Will these three businesses pass the 'cost-of-exit' test?"

B. "Did we miss the opportunity to milk these cash cows?"

C. "Do we need to do the math to achieve 1+1 = 3 outcomes from these diversified businesses?"

D. "If we were not in this business today, would we want to get into it now?"

E. "Why couldn't we derive a parenting advantage with these businesses?"

Answer: D. "If we were not in this business today, would we want to get into it now?"

You might also like to view...

What causes the production possibility curve to be bowed out?

What will be an ideal response?

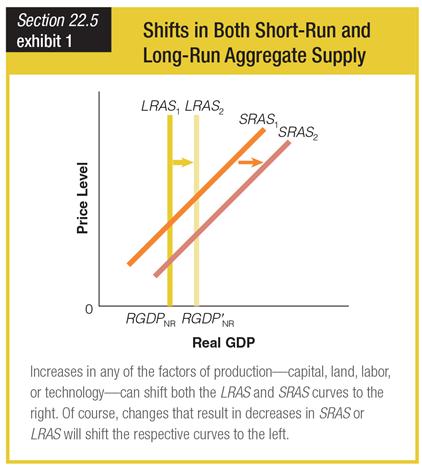

Which of the following statements accurately describes the situation shown?

a. a movement along the short-run aggregate supply curve and an upward shift in the long-run aggregate supply curve

b. a rightward shift in the short-run aggregate supply curve and a rightward shift in the long-run aggregate supply curve

c. a movement along the long-run aggregate supply curve and no change in the short-run aggregate supply curve

d. a leftward shift in the long-run aggregate supply curve and a rightward shift in the short-run aggregate supply curve

Inefficiencies associated with majority voting may get resolved through:

A. Using the median-voter model B. Bureaucratic inefficiency C. The paradox of voting D. Political logrolling

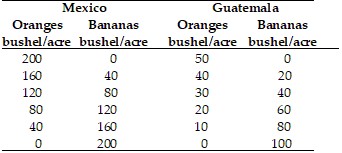

Refer to the information provided in Table 20.1 below to answer the question(s) that follow. Table 20.1 Refer to Table 20.1. Mexico has

Refer to Table 20.1. Mexico has

A. a comparative advantage but not an absolute advantage in orange production. B. an absolute advantage and a comparative advantage in orange production. C. an absolute advantage and a comparative advantage in banana production. D. a comparative advantage but not an absolute advantage in banana production.